Home Equity Loans and Home Equity Lines of Credit

Table of Content

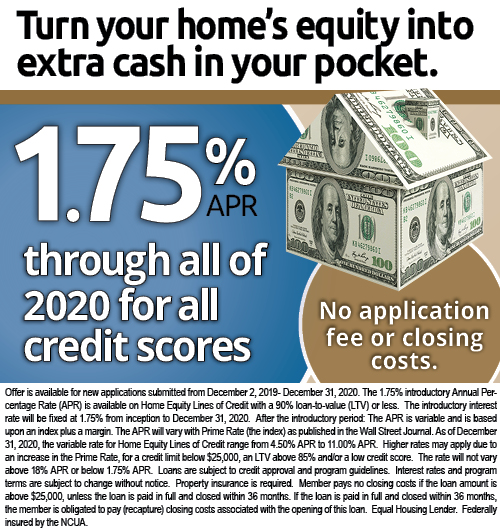

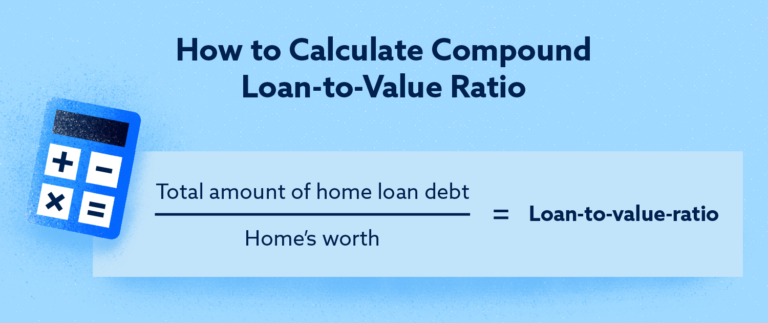

Home equity is the difference between your home’s current market value and your mortgage balance; it can be positive or negative. When it’s positive, it’s an asset you can draw on, typically up to 80% of your home’s value, which can be key when you have few other assets . It’s also a cushion against a market downturn that could otherwise prevent you from selling your home. The amount you’re able to borrow depends on your current home equity. The calculation lenders use to determine your loan amount is called a loan-to-value, or LTV, ratio. It’s expressed as a percentage, calculated by dividing your outstanding loan balance by the appraised value of your property.

Your behavior and attitude when it comes to debt have to change. However, if you're thinking about rolling your debt into a home equity loan, you need to figure out WHY you feel you need to do this in the first place. But I think consolidating your debt into a home equity loan is an extremely bad move, and I'll tell you why below. Chase Bank serves nearly half of U.S. households with a broad range of products. For questions or concerns, please contact Chase customer service or let us know at Chase complaints and feedback. There’s no shortage of ways to use home equity, but the most common uses of home equity are for home improvements and debt consolidation.

Second Mortgages

It may take a few weeks for you to have access to your loan or line of credit. “The home equity market, in some ways, is a mirror of what goes on in the primary mortgage market,” says Cook. The prime rate, which is the benchmark for many HELOCs, tracks increases in short-term interest rates by the Federal Reserve. Given the Fed’s ongoing bid to lower inflation, that rate is expected to keep rising through the end of year. This handy guide will help you decide exactly how much of your salary you should be spending on mortgage payments every month. If you’re looking to add an extra room to your home or craving more space, using your home equity can work in your favor in more ways than one.

When you're renovating your home, that flexibility can be a good thing. It's often hard to accurately estimate how much renovations will cost. If you take out a $20,000 home equity loan but the work ends up costing $25,000, you'll be short.

Recap: How mortgage interest rates have changed this week

A home equity loan may be a smart tool if you’re looking to get your finances in order. Please know, though, that consolidation doesn’t change spending habits. You might max out your credit cards again if you’re not taking the time to address the underlying issue. The percentage of your home's available value is called the "loan-to-value ratio," and what's acceptable can vary from lender to lender.

"The cost of this borrowing is greater than we've become accustomed to, and so, too, is economic uncertainty. That's not a good combination," he says. If your business fails and you can't pay back your loan, you could lose your house to foreclosure, which is why there are better alternatives to fund the start of your business. Marc is senior editor at CNET Money, overseeing banking and home equity coverage. He's been a financial writer and editor for more than two decades, working for The Kiplinger Washington Editors, U.S. News & World Report, Bankrate and Dow Jones.

Jobs and Making Money

A 125% loan, often used in mortgage refinancing, allows homeowners to borrow more money than the equity they have in their property. To pay for college – Going to college can be a smart investment in your financial future, but using a home equity loan to pay for it is risky. There are other ways to pay for college that don’t require risking losing your home. If you’re thinking of college for yourself or someone in your family, consider one of those payment alternatives rather than taking out a home equity loan to pay for college. As home prices continue to climb, it’s hard to imagine your home losing value — but that’s exactly what happened a decade ago during the housing crisis.

Talk to your lender to decide on a repayment term that works best for you. These rates do not include interest payments, which are an important factor in how much you pay each month. At NextAdvisor we’re firm believers in transparency and editorial independence.

How Do Lenders Calculate Student Loan Payments

There are a lot of people out there giving personal finance advice that will advise you to do that when you're trying to pay off your debt. Our affordable lending options, including FHA loans and VA loans, help make homeownership possible. Check out our affordability calculator, and look for homebuyer grants in your area. Visit our mortgage education center for helpful tips and information.

If there’s one constant among scammers, it’s that they’re always coming up with new schemes, like the Google Voice verification scam. How to protect your personal information and privacy, stay safe online, and help your kids do the same. Before you commit to taking this action, run the numbers on your business. As with using your home equity to purchase investments, a return on investment in a business isn’t guaranteed.

That’s why we teach people to put at least 10–20% down when buying a home and then pay that sucker off as fast as possible! The borrower is slave to the lender, so you want to get out of debt quick. With a cash-out refinance, you owe the amount left on the original mortgage—and you borrow more money against your home’s equity. So, you’re basically going backwards and defeating the purpose of refinancing, which is to get out of debt quicker. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.

Editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by our partners. Editorial content from NextAdvisor is separate from TIME editorial content and is created by a different team of writers and editors. These rates come from a survey conducted by Bankrate, which like NextAdvisor is owned by Red Ventures. The averages are determined from a survey of the top 10 banks in the top 10 U.S. markets. Consolidating debt can help you save monthly and in the long-term, but you’ll want to check the math carefully, because everyone’s financial situation is different. You can typically find home equity loans for anywhere from five to 30 years, depending on your needs and financial situation.

Compared to a shorter term, such as 15 years, the 30-year mortgage offers lower, more affordable payments spread over time. Like a traditional mortgage, a home equity loan is an installment loan repaid over a fixed term. Different lenders have different standards as to what percentage of a home’s equity they are willing to lend, and the borrower’s credit rating helps to inform this decision. Because home equity loans use your home as collateral to secure the loan, it’s important to weigh the pros and cons of this type of borrowing carefully. A home equity loan could be a good idea if you use the funds to make home improvements or consolidate debt with a lower interest rate.

However, a home equity loan is a bad idea if it will overburden your finances or only serves to shift debt around. Bear in mind that you typically must pay closing costs if you take out a home equity loan. Closing costs generally range from about 2 to 5 percent of the loan amount. The interest rate on the equity loan depends on your credit score. This means you should have a good credit score to apply for a home equity loan effectively.

A second mortgage is when you sacrifice your own home equity in exchange for a faster way to pay for things like home improvement projects or other debts. Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Then you have to pay back some of what you owe before you can spend more. Speaking of years, that’s how long repaying your home equity loan takes—anywhere from five to 30, to be exact.

Comments

Post a Comment